4 Things Left Out of the ACA That Brokers Can Capitalize On

I was born in Canada the year nationalized health care started there (that was 1967 for you history buffs). It was well-funded and provided great care for a few decades. But medical inflation was out of control. By 1991, when I moved to the U.S., the medical plans started to get stripped down to the bare minimum. This opened up opportunities for brokers to add new employee benefits to their suite of offerings.

Would it surprise you to know that today Canada has a thriving employee benefits market? Brokers sell multiple products and services that keep them busy and profitable. Employers appreciate their support. This growth hasn’t been with medical plans — instead, it’s come from services not covered by the national health plan.

I discussed these ideas in my keynote presentation at last week's Workplace Benefits Mania in Las Vegas and in an article for Employee Benefit News.

I’m sharing four categories that hold tremendous growth opportunities because they’re not part of the Affordable Care Act minimum plans. Some are already on the market, and some are yet to be developed by carriers. So, sit back, grab a coffee and find a few things you can get behind!

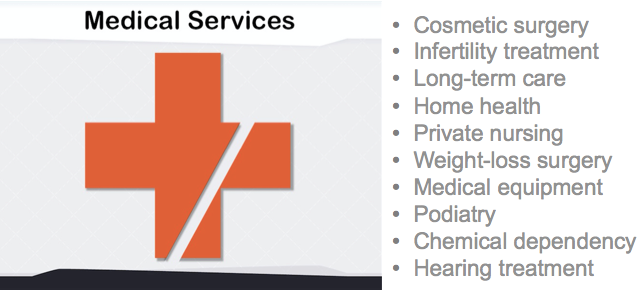

1. Services stripped out from traditional medical plans can be new employee benefits:

Many things that used to be covered for most Americans are no longer included in the typical employer-paid or individual plan. Also in this category are services that were optional on some plan designs and I don’t foresee them ever returning. Many Americans would happily pay separately for these services as a kind of new employee benefit. Some are already available and others may show up in carrier offerings in the future:

4_things_left_out_of_aca_medical_services.png

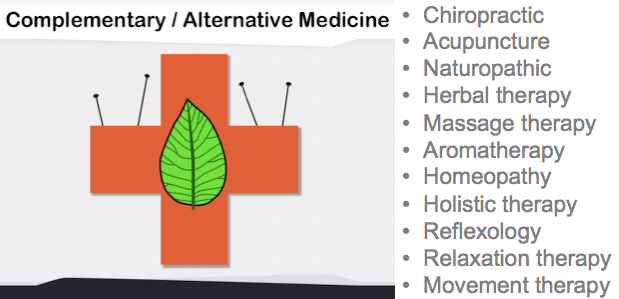

2. Complementary and alternative medicine:

For more than a decade, the American health care industry has been driving citizens to become better consumers. Some people have responded by finding sources outside of traditional Western medicine. Entertainment shows like The Biggest Loser have made many of these services mainstream. For those of you who think you’d never try something from this category, raise your hand if you’ve ever had a chiropractic visit. Then, consider the opportunity in selling such programs to your clients:

4_things_left_out_alternative.png

3. Filling the financial holes:

We can all agree that medical rates are skyrocketing. Therefore, out of pocket costs are also increasing drastically. The biggest need is to help employers and/or employees fill those ‘holes’ in medical plans with other services that keep cash in people’s pockets - or services that help people be better consumers. These needs have been serviced through Worksite and Voluntary Sales for decades. It’s a category that will continue to develop as a new employee benefit:

4_things_left_out_financial_holes.png

4. Future trends and advancements:

The speed of advancement will also bring new opportunity for those in the employee benefits industry. I see three main trends for new employee benefits:

- More product choices: The volume of product choices is driving the need to simply, efficiently and effectively present those elections at the employee level. By level, I mean: 1) at their understanding (this business is complicated stuff), and 2) personalized for each individual. Many new opportunities will appear including: benefits technology, exchanges, single-billing services and enrollment services.

- New advancements: As new medical advancements developed over the past 15 to 20 years, the goal of the developer was to have it included under health insurance plans. Mandated coverage was the objective — it was also one of the drivers of medical inflation. No longer. I believe many future advancements will take a lesson from industries such as cosmetic surgery — they won’t even try to be included under health insurance. Some of the obvious trends on the immediate horizon include: more cosmetic treatments, specialty drugs and genetic testing/therapies.

- Doctor shortage: All the projections say there aren’t going to be enough doctors to serve Americans in the coming years. By 2025, we’ll be short 46,000+ physicians. Imagine your medical-plan clients trying to squeeze in an appointment for the flu or a urinary tract infection — how will they respond when told they can’t get in for two weeks? We’re also seeing (and expect to continue to see) the shrinking of networks. How do you serve a group that doesn’t have near the same access as before? Both of these trends will expand the opportunity to access providers in unique ways like concierge nurses/PAs/doctors, telemedicine services and electronic wearables / iPhone plugins.

We’re entering a time like the Wild West — there will be a lot of changes and advancements. Keep your eyes open for some new opportunities you can get behind and sell.

You disagree? Tell me. You agree? You're allowed to tell me that, too. What other changes do you see coming? Comment below or send me an email at reid@freshbenies.com.