Hey Broker! Are You Changing With The Times?

We’ve all seen huge changes in our industry. We went from indemnity plans to PPOs to managed care to ACOs. The changes keep coming and more ferociously.

As benefit consultants and teachers of the ways to save money on healthcare, we need to continue changing our spots. So far, we’ve been successful in our messaging to get clients to make choices to reduce healthcare costs. We've gotten them to stop using the emergency room and look toward the urgent care center as a less expensive alternative. Along those lines, we educated clients to use generic drugs instead of brand names.

However, are we changing fast enough? Are we doing a disservice to our employers and their employees in a rapidly changing industry? With the new technology available, whether through the computer or mobile device, options to further reduce healthcare costs are plentiful. If you’re still promoting the same old cost-cutting ideas of the past, you may be part of the problem instead of the solution and your competitors will overtake you.

An insurance friend recently posted this statement on social media, and it really got me thinking:

“I’ve officially reached the stage of parenthood that the receptionist at urgent care knows my name when I walk in.”

It’s good that she doesn’t reference the receptionist at the ER. It shows we’ve made progress at changing those habits. But there are now faster (and less expensive) ways to access care, and yet even those of us inside the healthcare industry don’t embrace them fast enough (yet). How can we do better?

Why not look to technology and innovation to increase access to care, provide true transparency to the cost/quality of care and help our clients save on medical services? For instance…

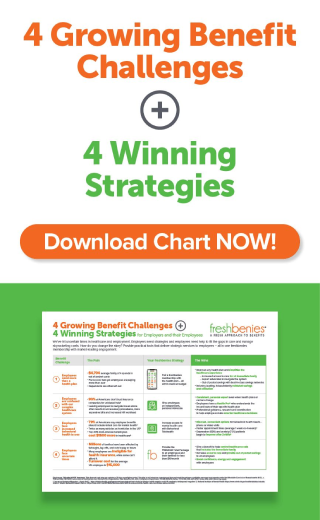

- We’ve been touting transparency for years, but have we really provided the tools to help this become a reality? Advocacy services help clients shop for pricing on procedures allowing them to make an educated decision about their care and costs. Advocates can also reduce healthcare costs by reviewing for accuracy, organizing and negotiating medical bills. This removes the burden for employees, employer HR teams and even your office.

- What about telehealth? For common ailments, clients can call or video chat with a physician and get a prescription written rather than going to a “building” for a care. With other programs, clients can email questions to specialists (vs. a Google search) and get real-life, quality answers from experts.

- How about a savings program for prescriptions, dental and vision care? Again, the discounts can bring about transparency and allow the end user to save AND have control over what’s best for their care.

- There are many in-home tech advancements – with more on the way. Adhesive thermometers send updates to your phone as your child’s temperature changes. Sensors tied to wearables or phones measure blood pressure, heart rate, blood sugar, calorie intake, etc. As they become available, will you embrace and evangelize such advancements?

In the future, I’d love to see a friend post something like this…

“As a mother of two under 2, I’m so glad I was able to save time and money by calling the doctor. All I had to do was send my husband to grab the prescription.”

If we don’t stay on top of such changes, who will? As our industry changes, so should our messaging. As the world around us transforms, so must we. We are the benefits professionals and should be the first to implement solutions and strategies that make a member’s experience and quality of care fabulous – while providing true solutions for our employer clients.

It makes for great care. And that makes for great business.