“Piece of cake,” I thought when I was asked a few weeks ago to write an article in early October about the upcoming presidential election. I was confident that, one month before Election Day, we’d have a pretty good idea who our next president will be and how his or her proposals will affect the health insurance industry. Boy was I wrong.

For years, insurance experts have used LASIK surgery as proof that “consumerism” in health care can actually improve outcomes. Over the past couple decades of the popular eye surgery, quality has gone up while costs have gone down, and most experts attribute these results to the fact that Lasik isn’t covered by most insurance plans. With no third-party payer in the middle to distort the price or hide it from consumers, LASIK providers actually have to compete for business.

Boy, this defined contribution thing just won’t go away! Though the IRS and DOL have repeatedly told us that employers absolutely, positively cannot pay for individual health plans for their employees, some people just didn’t like that answer. A lot of people, actually – on both sides of the aisle. And they decided to do something about it.

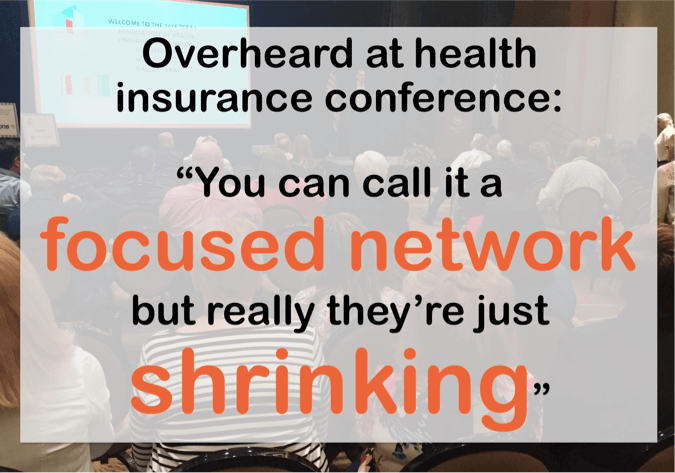

I don’t get a chance to attend a ton of insurance conferences, but I always love to go! It gives me a chance to hear what’s going on in the industry, and to meet up with our clients, vendors and brokers.

The Texas Association of Health Underwriters conference was last week and we took some of our newer marketing and service team members so they could have a chance to do the same.

One might expect a health insurance conference to be boring. What? Shocker! As I embarked on my first Benefits Selling conference, I was hopeful, but expecting it to be like many others.

GOOD NEWS! It was SO much better than I expected (my article picture is from some other conference). Following are my top 10 AHA moments…

Have you ever been to a conference focused on healthcare and legislation? Well, let me tell you – it is one rockin’ time! The conference was hosted by the National Association of Health Underwriters (NAHU) and it was called Capitol Conference. We dubbed it Cap-Con, for short. While it was no Comic Con, I enjoyed it more than I thought I would.

A few weeks ago, I published an article entitled “Is this the beginning of the end for the ACA?” For someone who’s normally pretty positive, this article was fairly pessimistic. Here’s the short version:

I was born in Canada the year nationalized health care started there (that was 1967 for you history buffs). It was well-funded and provided great care for a few decades. But medical inflation was out of control. By 1991, when I moved to the U.S., the medical plans started to get stripped down to the bare minimum. This opened up opportunities for brokers to add new employee benefits to their suite of offerings.