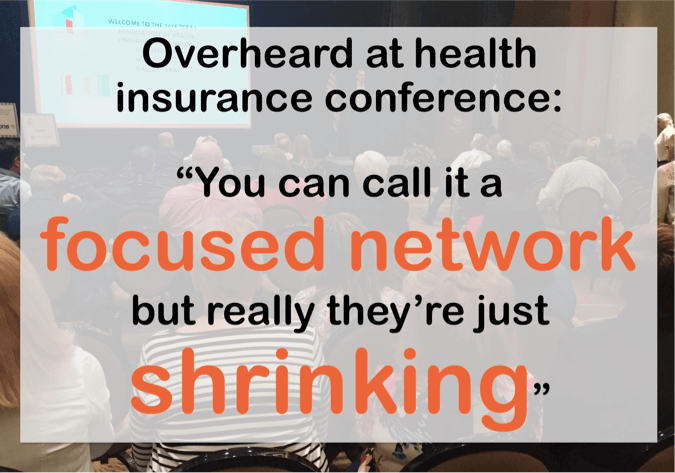

Insurance carriers know it. If you build self-funded plans, you know it. There are ways to reduce plan costs while ‘hiding’ the reduced benefits. One of the rapidly growing methods is to shrink the provider network, which impacts patients' access to healthcare.

If I’ve heard it once, I’ve heard it a thousand times: “This is a great product.

“Selling just medical insurance to a group should earn an 80% retention rate. Sell just two more lines of business and it jumps to 93%!”

I’ve quoted this health insurance sales statistic for more than a dozen years. The source is long gone, but I haven’t heard it refuted in all that time, so I’ll still quote it (if you have different experience, please comment below).

As a busy employee benefits consultant, do you have time to talk with multiple vendors about product details? Probably not.

However, is it important to your business? Yes. Do you need to find time to learn about new ideas and solutions to meet the challenges you and your customers face? My guess is the answer is, “Absolutely!” You likely consider that to be a good investment of your time.

So how can you quickly determine if a vendor offers a true solution? Based on my experience, below are 4 tips to efficiently learn about new vendor solutions, products, ideas…

I don’t get a chance to attend a ton of insurance conferences, but I always love to go! It gives me a chance to hear what’s going on in the industry, and to meet up with our clients, vendors and brokers.

The Texas Association of Health Underwriters conference was last week and we took some of our newer marketing and service team members so they could have a chance to do the same.

Star Wars Episode VII launched last year, so we can confidently state that we are in ‘the future.’ Despite this, the healthcare industry tends to lag behind. For instance, we still can’t replace arms (Luke Skywalker) or restore burned, limbless bodies to (arguably) perfect working condition (Anakin Skywalker/Darth Vader).

One might expect a health insurance conference to be boring. What? Shocker! As I embarked on my first Benefits Selling conference, I was hopeful, but expecting it to be like many others.

GOOD NEWS! It was SO much better than I expected (my article picture is from some other conference). Following are my top 10 AHA moments…

Why do your clients offer an employee benefits program? This is an important question because the way you approach it will impact your recommendations and business. Some think of their employees as family members and want to make sure they’re taken care of. Others do it to avoid the ACA’s employer mandate penalties.