Brokers, are you missing this HUGE untapped market?

Think about your current clients. Your book of business consists of a diverse set of employers and employees. But, what percent of their employees do you actually serve?

With clear rules stating who is and isn’t eligible for benefits, most brokers zone in on the benefits-eligible segment as they present their strategies to the employer. Obviously, this is a necessary step, but have you considered the untouched opportunity that traditional strategies miss?

Today, I’m sharing an opportunity and 3 reasons a medical plan shouldn’t be the “end all be all” of your strategy, both in your prospecting and retention efforts…

The Problem

The fact that an employee isn’t full-time doesn’t preclude them from having medical issues, nor does it prevent those medical issues from impacting their employer. Absenteeism, financial burden from out-of-pocket costs and employee churn all impact your employer clients.

Just because a group isn’t financially able to provide medical insurance to everyone doesn’t mean they don’t want to offer SOME benefits. Two large segments immediately come to mind…

1. Employers with a mix of part-time, contracted and 1099 workers. Think restaurants, retail, hospitality, construction, or start-ups and businesses with heavy admin needs.

2. Employee dependents not included in the medical plan.

Leaving these big populations without any benefits runs counter to your goal of acting on your client’s behalf to provide a benefit package that serves the needs of their ENTIRE team.

Real-Life Example

We recently had a broker with a car wash company client ask about adding freshbenies for a small population of employees. Upon asking more questions, we learned that they had…

• 800 total employees

• 200 benefits eligible

• 600 non-benefits eligible

WOW! That’s a lot of employees who aren’t getting any benefit from the “benefits plan.” Because this broker saw a need and met it, a population of employees will receive an employer-paid full freshbenies membership – and 600 employees will receive an employer-paid freshbenies $2 freshSAVINGS pack with the option to purchase additional freshbenies services via payroll deduction.

The Opportunity

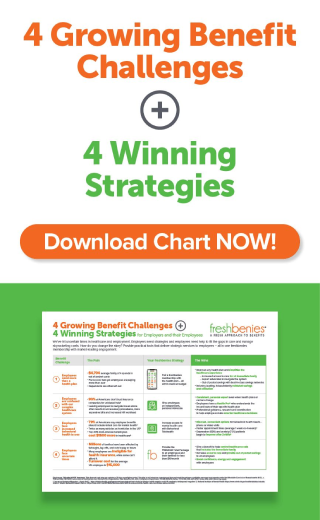

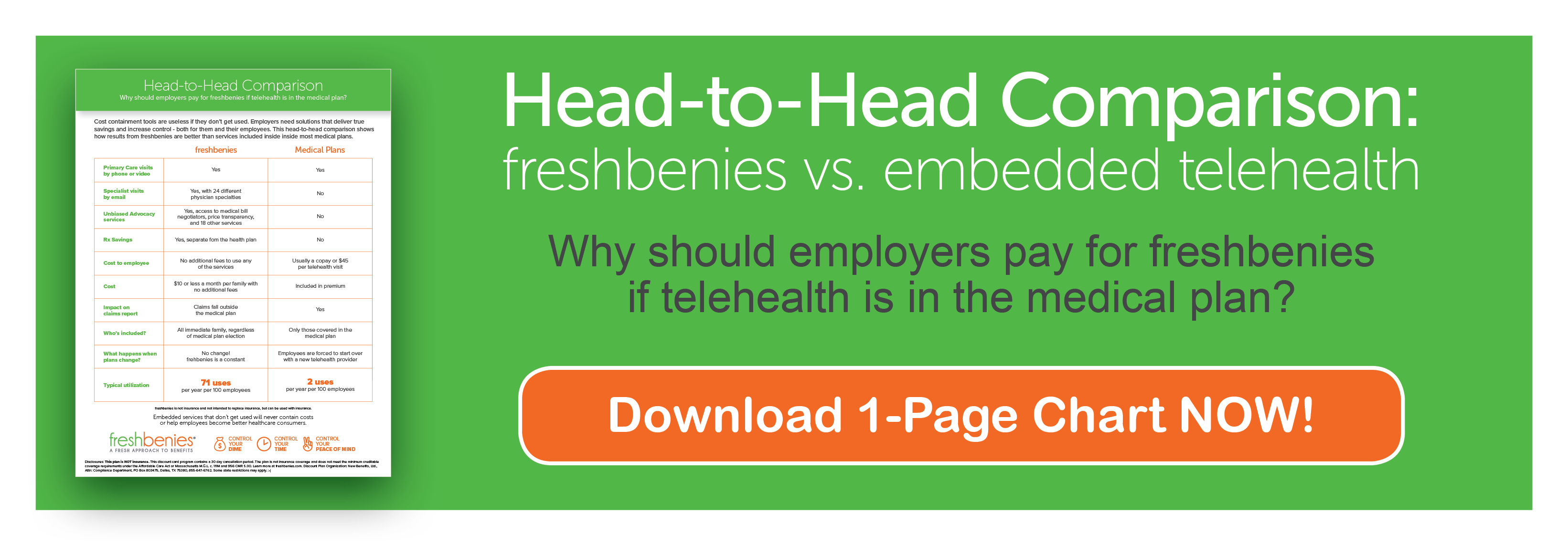

Non-insurance benefits, including savings networks, are a perfect approach for almost every group. It bypasses those pesky rules and regulations discriminating between eligible and non-eligible employees, while bringing solutions to both populations. These services come in handy because they…

• Work with and without medical plan

• Control healthcare spend for ALL employees

• Include employees and their dependents

With or without insurance, there are times employees pay full price for healthcare services on their own – like when they haven’t hit a deductible or out-of-pocket max. The freshSAVINGS Pack combines 9 best-in-class networks for $2 PEPM with benefits ranging from dental, vision, and chiropractor to diabetic supplies and lab test savings. They give employees real ways to save – click here to learn about the services and 8 real-life saving scenarios.

I’m sure you get it and are drawing your own conclusions about how these services could be helpful, but let me outline 3 reasons…

Reason #1

Medical insurance can cost your clients hundreds per employee. Adding dependents quickly multiplies their expense. And today, more of these costs are pushed to the employee than ever before – an average of $12,000. With these types of non-insurance services, you can give your employer clients an affordable way to help.

Reason #2

It’s low-hanging fruit for YOUR business. Most business owners will tell you it’s WAY easier and less expensive to sell more to your current clients than to go find new clients. What other benefits do you have in your arsenal that are inexpensive, easy to install, useful to anyone, and offer true savings without discrimination rules?

Reason #3

Asking your employers, “What benefits are you providing to all your non-benefited employees?” is guaranteed to separate you from your competition. Showing them scalable options that improve benefits for their entire team positions you as a consultant with a comprehensive view of their needs.

Sure, this shift to approach clients with non-insurance healthcare solutions may take you into uncharted territory – but don’t mistake it as a complete upheaval of your benefit selling strategy. Instead, it’s a great strategy to grow your existing book of business with current and prospect groups.

Now it’s your turn! What other approaches or benefits do you present to groups? I’d love to hear your stories. Comment below or email us at brokers@freshbenies.com.