Benefits & Healthcare in 2019: 10 Predictions

As your 2018 selling season comes to an end and you finish open enrollments, I’m sure you’ve started thinking about next year: what will change, what will stay the same and what will drive client conversations?

Over the year, I attended dozens of conferences, spoke with thousands of benefits consultants, and read hundreds of thousands of words about our industry.

Based on all that and my “few years” in this fine industry, I’m sharing predictions for 2019.

1. Costs will rise. Again.

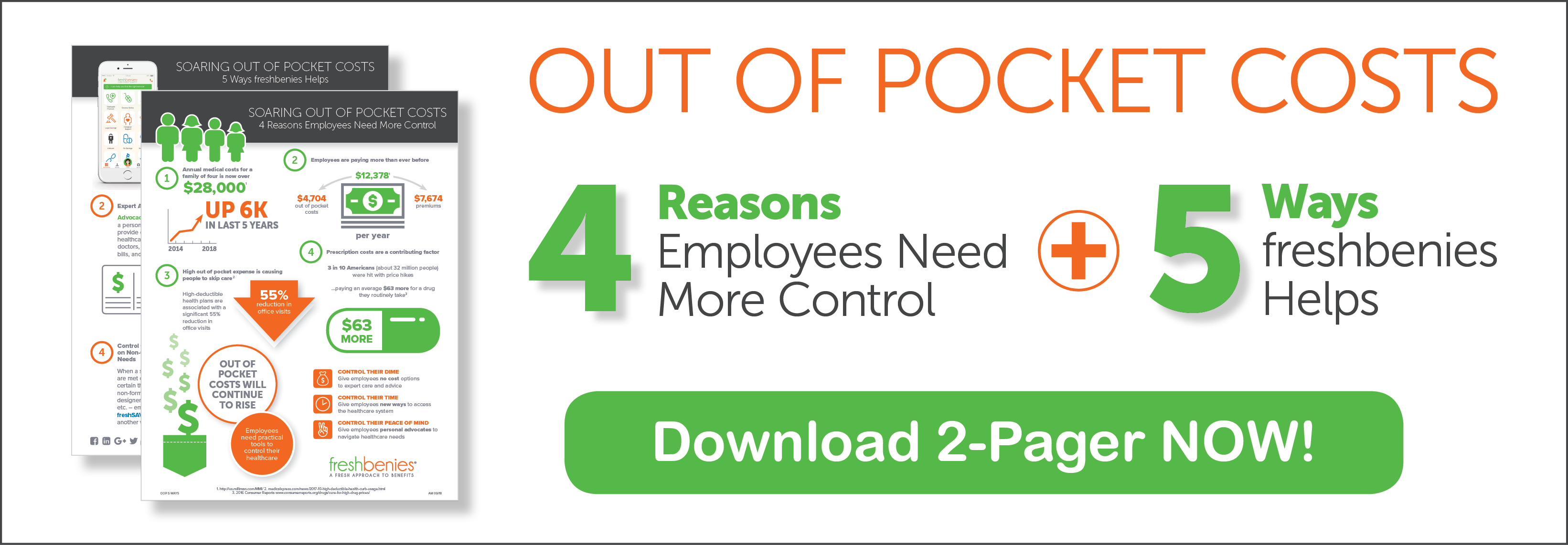

It’s obvious to all of us inside healthcare, so why would I even list it (let alone as #1)? Because it can’t be ignored. Total healthcare costs for a family of four will surpass $29,000. Premiums for that family will be $8,000 with a $4900 average out of pocket cost. In 2019, families will continue to carry higher portions of healthcare increases, and it shouldn’t be overlooked or forgotten.

2. Low unemployment will drive creativity.

While rate increases are a constant, the biggest shift this year is a 3.7% unemployment rate. Fear of loss is always a better motivator than the desire for gain. A tight labor market will drive employers to try innovative solutions more readily. This includes creative benefit plan designs, perk programs (more on both of these below), and programs for non-benefitted employees.

3. Innovative benefit plans will gain momentum.

The pendulum will begin to swing toward less traditional plans, including:

- Value-Based Insurance Design (VBID)

- Reference-based pricing models

- Association health plans

- Capitve medical plans

- Direct Primary Care (DPC)

- High-performance centers of excellence

When suggested in the recent past, many companies have declined to install these ideas amid complaints of complexity, employee confusion or skepticism of savings. But given the low unemployment rate listed above, and the fact that consultants are getting better at explaining these solutions and pulling them together – these types of benefit plans will increase.

One study by Forbes predicts 15% of all healthcare spending next year will be tied to value-based models. I still expect members will complain about confusion under these new systems, but employers will “rip off the band-aid” and power through.

4. Perks will pop.

“Perk” benefits will continue to gain interest and traction. Services like gym memberships, healthcare navigation experts, no-visit-fee telehealth, consumerism savings networks, pet care, identity theft protection, flexible hours, remote work, student loan repayment, car wash services, free snack programs, etc. are often the things people list when they brag about their workplace culture. They’ve become differentiators even among the big expense of health insurance. An employer can lose an employee to another company from the draw of perks that scratch an itch the employee didn’t even know they had.

5. “Caring” support for workers will grow.

Every employer says they care about their people. But how do they actively show it? Smart employers are getting significant PR power by touting two specific sets of services…

- Behavioral Health – The US Department of Health & Human Services estimates that 96.5M Americans live in areas with shortages of mental health providers. Effective tools that offer video visits with counselors and psychiatrists or even text-based guidance with specialists provide employees with new methods of care.

- Caregiver Support – It’s estimated that 1 in 5 employees care for an adult family member or friend. This significantly affects an employee’s work life by adding stress and taking 15 to 20 hours of their time each week. New solutions are capturing employer interests, such as services that pair employees with a licensed coach whose expertise best matches their specific caregiving situation, as well as secure portals for documentation and collaboration. These benefits bring much-needed help, increase productivity and build tremendous loyalty.

6. Engagement will drive more decisions.

Continued rate increases coupled with poorly-implemented cost containment tools will draw employers to focus on achieving employee engagement. Stats revealing low utilization will bring cancelation of past programs. A shift will take place from checking the box of offering a service to moving the needle on ROI via higher utilization.

Your employers will be far less timid to drive employees to programs that…

- lower in-patient, urgent care or emergency room visits

- include Remote Patient Monitoring (RPM), Centers of Excellence, and wearables

- help employees navigate the healthcare system - from selecting top-tier physicians, and providing price transparency to medical bill review and negotiation

7. AI Growth will not be artificial.

Artificial Intelligence and machine learning in the healthcare app space will surpass $1.7 billion in 2019, while health data analytics will reach $68 billion. The strongest advancements will be with machine learning in diagnostic imaging, drug research and risk analytics. On the benefits side, we’ll see AI functions being touted throughout websites and apps. Beware of the member experience as these features grow, as many will still be weak in 2019.

8. Little help will come from DC - Republicans.

With a divided Congress, we can’t expect significant changes in federal health laws over the next couple years. Rather, most changes to the “flavor” of ACA will come from the thousands of issues inside the law that were at the discretion of the various departments like Health & Human Services.

I’m hopeful that we’ll see bipartisan agreement with updates to Health Savings Account (HSA) laws. What’s controversial about that, right? Right. So, I’m hopeful, but not holding my breath.

9. Lots of single-payer talk will come from DC - Democrats.

Remember those 8 years when Republicans grew to one consistent chant of “repeal and replace?” Turns out it was a great slogan, but there was no actual plan to implement. That’s exactly what “single -payer” is among Democrats this year.

Lawmakers have many different ideas about what these two words mean, but that won’t slow them down. Single-payer was one of the top subjects during the 2018 mid-term elections and it will gain traction throughout 2019, right into the 2020 election. But I don’t expect the idea to gain any real ground or that a workable plan will be developed.

10. True employee benefit consultants will be in demand.

Brokers who aren’t improving their knowledge will fall by the wayside – it’s a huge driver of the consolidation that’ll continue in 2019. As a result, true consultants will be in demand more than ever before.

What does this look like? Change your story, update your online presence (website, LinkedIn, etc.). Stop saying how many decades you’ve been in business and start talking about results. Improve your discovery conversation with clients and stop “spread-shitting” rates. Develop new approaches, new marketing, new technologies. Don’t talk about how busy you are. Make time to read a book, attend a conference, hire an agency consultant with reinvention expertise. Separate yourself from the crowd. Your clients are up at night wishing they had someone just like this to give them trusted guidance.

Hopefully, many of these 2019 predictions aren’t giant surprises to you. But don’t just nod and move along. Grab a coffee (or a beer) and mull over them with your industry friends. Be prepared to talk about these points with clients. Find ways to move your business toward these trends. Finally, leave a comment below about the things you disagree with – I can take it! Or, send me an email at reid@freshbenies.com.

Here’s to 2019 being a fresh year ahead!