5 HEALTH INSURANCE PLANS: WHAT'S RIGHT FOR YOU?

Here’s an easy question: have you seen your family’s healthcare costs increase? The stats say your insurance premium rose 69% since 10 years ago. If you’re among the majority of Americans who get their insurance through an employer, more of the monthly premium is being “shared” (oh, that’s so sweet) at a whopping 83% increase.

The trick, my friends, is to choose wisely and get good advice from a seasoned, professional insurance broker. I recently had a great visit with such a person - Tanya Boyd has over 20 years of experience in the insurance industry. She works with individuals AND employers, and has a passion to educate consumers on all of their options, starting with plans that save money without compromising benefits.

As you may know, whether you get your insurance through your employer or purchase it on your own, there are different types of insurance plans available to you. And if you purchase it on your own, your 2016 choices are even more complex. Under the Affordable Care Act (ACA), many people qualify for government help to pay for a plan.

Tanya took some time to share her tips and tricks to help navigate through the labyrinth.

Some housekeeping

For people who purchase on their own, insurance companies will publish new 2016 plan options and rates around November 1st, which is when you can start shopping. However, Tanya highly recommends scheduling an appointment with your local insurance broker NOW. If you don’t know one, click here to find a professional near you. Using an insurance broker is no additional cost to you (they’re paid by the insurance companies) and you can use them whether you qualify for government help or not – they’ll help you through that, too. If you get your insurance at work, your employer has most likely already worked with an insurance broker to come up with your plan choices. And if you’re an employer, having a trusted advisor is even more important. Times are a-changin’, so make sure you change with them.

For those purchasing individual insurance, below are some Open Enrollment Affordable Care Act dates to keep in mind…

- November 1, 2015: Open Enrollment starts. This is the first day you can enroll in a 2016 Individual Health Insurance plan. Coverage can start as soon as January 1, 2016 or as late as March 1, 2016.

- December 15, 2015: This is the last day to enroll in or change plans in order for coverage to start January 1, 2016.

- January 1, 2016: 2016 coverage starts for those who enroll or change plans by December 15.

- January 15, 2016: Last day to enroll in or change plans for new coverage to start February 1, 2016

- January 31, 2016: 2016 Open Enrollment ends. Enrollments or changes between January 16 and January 31 take effect March 1, 2016. NOTE that if you don’t have insurance, you’ll pay a penalty.

If you don’t enroll in a 2016 plan by January 31, 2016, you can NOT enroll in a health insurance plan for 2016 (unless you qualify for a Special Enrollment Period).

If you get insurance through an employer, these dates don’t apply to you, but our tips will help as you’re probably making plan choices in a benefits enrollment meeting in the near future.

How to prep

UGH! There are SO many choices! How are you supposed to know which plan to choose? Below is a list of questions Tanya suggests asking yourself whether you buy insurance on your own or through an employer…

- How important is your doctor relationship? Are you willing to pay lower premiums if it means changing doctors?

- What is your family makeup?

- Do you have small children?

- Are you expecting or do you plan to have a child in the calendar year?

- Tanya notes, “With wee little ones, some people want to know they can go to the doctor whenever they need to, so I would direct them to a plan with co-payments.”

- Not counting preventive care or common illnesses, how many times do you go to the doctor in a typical year?

- What medications do you take?

- Do you know the cost? If not, can you find out?

- Is it a long-term or short-term medication?

- How much out-of-pocket expenses can your budget handle?

The plans

Now, that we have some basic info, we can discuss the types of plans that are available and what might be best for you.

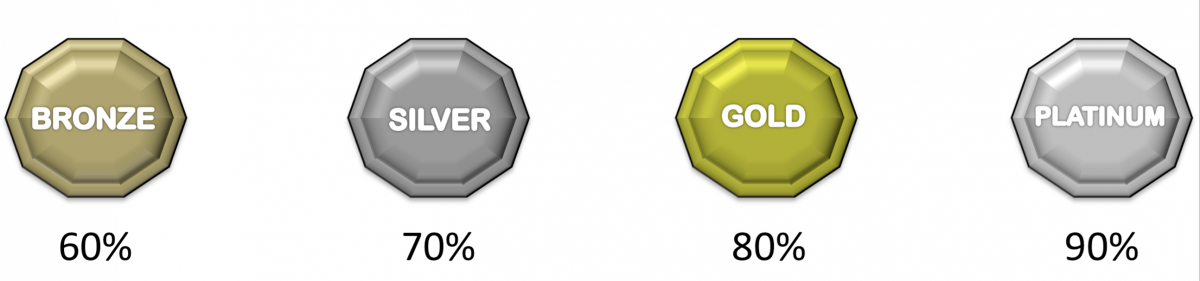

Under the ACA, “metallic” plans were created to help categorize all the choices and describe the different levels of coverage – Bronze, Silver, Gold, and Platinum. For example, with a Bronze plan, the insurance company would cover 60% of your health costs and you would pay the other 40% and so on...

If you get your insurance through an employer, you may not see these exact terms, but you’re choosing from similar plans in your benefits enrollment meetings, so this advice is good for you, too.

Note that the following advice is for people who DON’T qualify for subsidies and cost-sharing programs. We’ll cover more on that later.

1) BRONZE

A Bronze (or high out-of-pocket) plan might be right for you if you…

- are relatively healthy

- want a lower monthly cost

- don’t take a lot of prescription medication

- don’t foresee any major medical expenses (surgeries, procedures, diseases)

- take advantage of covered preventive care visits, but don’t visit the doctor often

- are comfortable with an approximate $6,000 individual or $12,000 family deductible and out-of-pocket maximum (keep in mind, these amounts vary by insurance carrier.)

“Under this type of plan, you’ll pay out-of-pocket for all medications and any non-preventive care doctor visits. Some people say they don’t like this type of plan because ‘nothing is covered.’ But that’s not necessarily true. Preventive care is covered – all well-visits are free. And, you won’t pay full price for a non-preventive care visit as long as your doctor is in the insurance company’s network. This is called a PPO/HMO/EPO discount – it’s what your doctor and the insurance company agree they can charge you, and it is ALWAYS less. You’ll see up to 60-70% discounts, so a $900 specialist visit might cost you $200 because of your insurance plan. While you’re paying out-of-pocket for medications, you’ll receive the insurance company’s discounted rate here, too. With a Bronze plan, the idea is that you’ll pay for your day-to-day medical expenses, but still have coverage if there’s a big medical issue and you can take full advantage of the insurance company’s negotiated discounts.” Finally, many Bronze Plans are HSA (Health Savings Account) Compatible. Perfect for people who want to use tax-free dollars to pay for some of their medical expenses.

Don’t forget – everything you spend goes toward your plan’s “Maximum Out Of Pocket” amount. This is the most you’ll pay in a calendar year (as long as you choose providers who are in your insurance company’s network.)

2) SILVER

A Silver (or high out-of-pocket with co-payments) plan might be right for you if you…

- like the idea of co-payments for non-preventive doctor or specialist visits. Instead of paying the entire cost out of pocket (like under a Bronze plan), a doctor visit co-pay may be $30ish and a Specialist co-pay might be $50ish.

- take expensive or specialty medications. “Again, instead of paying the discounted cost (like under a Bronze plan), you might have a co-pay of $10 to $150 max for specialty drugs.”

- have young children

- have a chronic condition that requires maintenance meds or monthly blood work.

- are comfortable with an approximate $6,350 individual or $12,700 family deductible and out-of-pocket maximum. Some plans have lower deductibles, but the out-of-pocket max is similar

“Under this type of plan, you’re paying more each month, but you have the convenience and security of a co-pay instead of paying fully out of pocket for day-to-day medical costs. The big question is whether it’s worth the difference in monthly premium to have the convenience of a co-pay. I always ask about how many times a client visits the doctor, because we can do the math: what is the additional premium and co-pay cost of the Silver plan versus the expected out-of-pocket cost of doctor visits in a year? This usually gives us a clear answer as to which will be the most cost-effective plan.”

“If someone is relatively healthy and they expect to have low medical expenses, I’ll direct them to a Bronze or Silver plan. If it’s compatible, I’ll also suggest a Health Savings Account. Because you’re buying a higher-deductible HSA-compatible health plan, the government allows you to put money into an HSA fund BEFORE paying taxes on it – this money can be used on qualified expenses including medical, prescription, dental, vision and more. With the tax break, it’s like getting a discount on your healthcare.”

3) GOLD

A Gold (or lower-out of pocket) plan might be right for you if you…

- want less out-of-pocket exposure. “These plans typically have a max of $3,250 out-of-pocket cost and then the insurance company pays 100%.”

- are planning a procedure – knee replacement, hysterectomy, etc.

- have a chronic disease – diabetes, lupus, etc.

- have special needs kids – ADHD, asthma, etc.

- were diagnosed with a serious illness – cancer, heart disease, etc.

“These plans cost a lot more each month, but they’re worth it if you’re a heavy user of the health care system. Unfortunately, an Individual purchaser isn’t able to get an HSA with a Gold plan that includes co-payments before the deductible. If you get your insurance through an employer, you may still qualify for an HSA with a Gold-level plan.”

4) PLATINUM

Tanya notes, “Platinum plans haven’t typically been available to an Individual purchaser in recent years. Insurance companies haven’t offered them because most people just can’t afford the monthly cost even though there may not be a deductible and the family out-of-pocket max is just $1,250. However, a few employers do offer these plans to attract and retain employees – especially in industries that are competing for specialized employees. Employers will typically offset the monthly premium for the employee, too.”

5) CATASTROPHIC

“These insurance plans were originally meant for people under 30 years old. However, after the ACA launched, they were extended to people who ‘may have experienced a hardship and found their insurance plans being canceled.’ These types of plans basically work like a Bronze plan, except they’re not HSA-compatible and they offer a limited number of doctor office visits with a co-pay (versus paying 100% out of pocket).”

Subsidies and cost-sharing programs

As part of the ACA, middle-income people who are not eligible for coverage through their employer, Medicaid, or Medicare, can apply for subsidies through their state exchange. What does that look like?

Tanya notes, There are 2 types of aid…

- A Subsidy, or Tax Credit reduces your monthly premium

- Cost-sharing reduces your out-of-pocket exposure

If you’re a family of 4 at 250% of the poverty level – in other words, you’re household income is about $60,625 or lower – you’ll be offered a Silver plan with lower monthly premiums and cost sharing. Instead of a $6,000 deductible and $12,000 out-of-pocket max, you might not have a deductible at all or it might be much less depending on your income level and family size. Not everyone who gets a subsidy will qualify for cost-sharing – this depends on where you fall in the poverty level. At 250% you get both. If you’re above 250%, you may qualify for just a subsidy.

WARNING!

Choices are changing and doctor and hospital networks are shrinking - accessibility to doctors and hospitals is extremely important, so you want to be sure you’re choosing wisely.

A recent poll showed that 41% of employees spend 15 minutes or less reviewing benefits options even though their yearly premiums now average $4,565. Yet, they’ll spend 8 times longer to research a television purchase and 40 times longer to research a new car purchase. Navigating through this health insurance decision each year is absolutely necessary and there’s a lot to consider.

Studies have shown when a shopper goes direct to purchase health insurance and doesn’t work with a broker, many end up cancelling their policy. Why? Because they don’t fully understand what they bought, no one explained the nuances, and they simply can’t use the plan. Choosing the right plan is important because it can make a big difference to two pertinent parts of your life: your finances and your health. So, take the time and get expert help.

Now, it’s your turn to tell your story! Have you spent some time navigating through this decision? What factors do you consider? Do you ask for help?