2 SALES STRATEGIES: ADDING NON-INSURANCE TOOLS TO A BENEFITS PACKAGE

What if I said selling employee benefits to employers isn’t the main goal for brokers? While reading our freshbenies book of the quarter, The Little Red Book of Selling, I was reminded a broker’s role isn’t to sell benefits packages, but to give companies the opportunity to buy benefits for their people. It’s an important distinction that redirects focus to a basic question: Why do companies make the decision to offer benefits to their employees?

I understand there are laws that require companies of certain sizes to provide health insurance plans and that there are tax incentives for other employers to offer coverage.

But, I’m sharing two core reasons companies provide benefits packages along with two sales strategies for adding non-insurance tools that meet those employer goals…

1. Attracting and Retaining Talent

This is far and away the biggest reason companies offer benefits. Success of a company depends largely on hiring and retaining the best team. A comprehensive benefits package goes a long way toward doing that – particularly in a more competitive market like we’re in now.

In order for you to stand out as a broker, give companies an opportunity to stand out with a unique set of benefits. When all other things about a job offer are equal, a benefit package with sizzle can be a game changer.

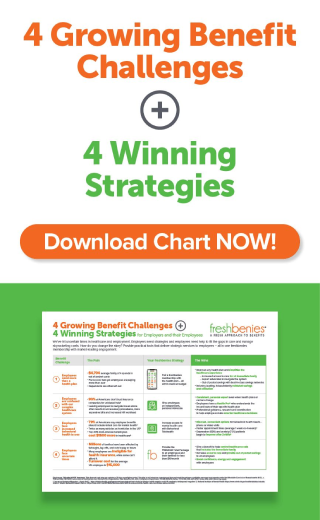

STRATEGY TIP: Compare “non-insurance benefits” on the market today. Understand the problem each one solves. Also, be sure to consider these points…

- What is implementation like?

- How much customer support does the provider offer?

- Are there options in how the service is used (online, app, phone)?

- Is the employee’s family included in the benefit?

- How does the provider drive utilization?

When consulting with clients, ask questions to uncover pain points with your solution-oriented homework. For example, many employers can’t afford the comprehensive plans offered in the past, so current offerings have some pretty big holes in them. Show clients how these non-essential services improve the essential insurance plan WHILE adding helpful and customizable options employees will like, appreciate and use. The health plan will always matter, but pairing it with practical, yet inexpensive tools can make employees appreciate their benefit package even more.

2. Keeping Employees Healthy

Depending on the size of the company, this can play out a couple of different ways for the employer.

In a large company, health maintenance and disease prevention are integral to productivity and the bottom line. Having a proper benefit plan in place raises the odds to keep those employees healthy, working, and productive by reducing downtime due to illness.

For small businesses, prevention and quick treatment are really critical because illness suffered by a key employee is more difficult to overcome. This factor extends to family benefits which impact the employee missing work to care for them.

Here’s another opportunity for you, as a consultant-minded broker, to step in with unique strategies for the employer that increase access to care for their employees.

STRATEGY TIP: Educate your clients that the adoption of telemedicine to treat minor illnesses like colds, flus, sinus infections, etc. is just the beginning of embracing new service options. Coach them on additional services that make it easier for employees to seek timely and appropriate care for themselves and their families (like direct access to medical specialists and healthcare experts to navigate an increasingly difficult system). Help your clients adopt these solutions ahead of the curve to maximize their workforce - AND bring cost containment tools for the medical plan.

So, go out there and give your clients and prospects the opportunity to provide benefits to their employees that deliver on their main reasons for offering benefits in the first place.

Now it’s your turn! How do you get creative and differentiate yourself and your clients with benefit packages? Comment below or email me at adam@freshbenies.com.