3 RX TRENDS & ONE SOLUTION

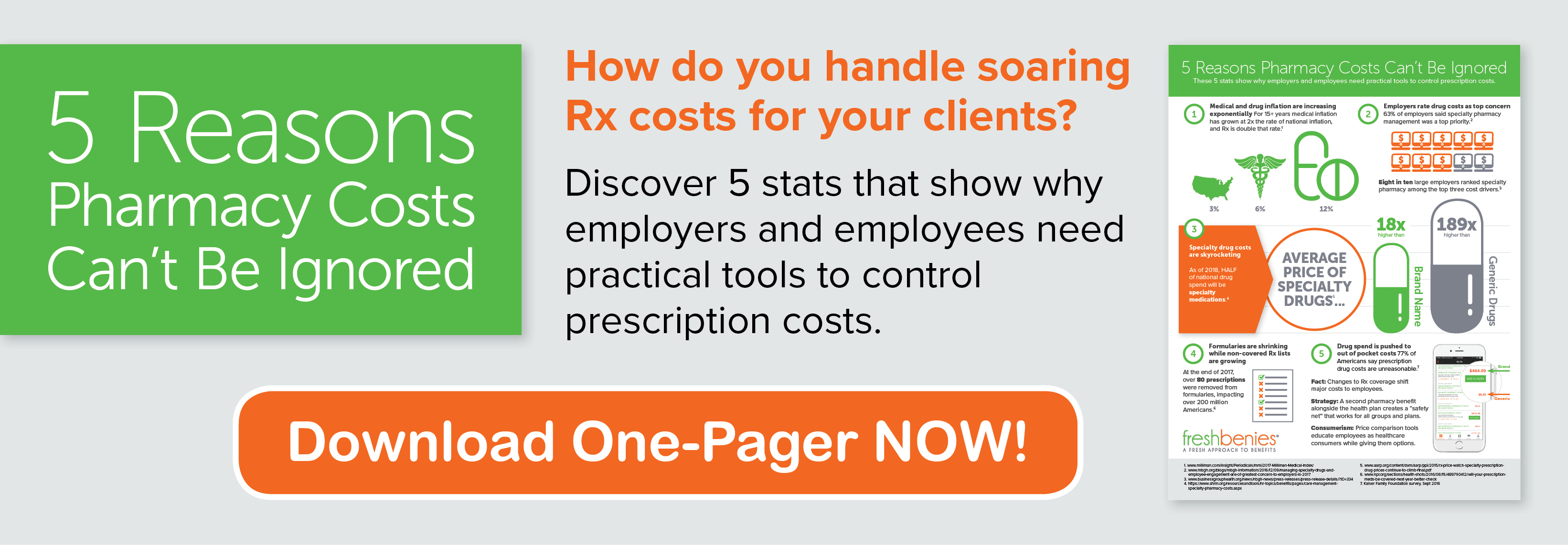

How do you handle soaring Rx costs for your clients? Pharmacy costs are driving up health plan pricetags, while fewer drugs are covered each year. This means employees are taking a huge hit in out of pocket expenses for their meds. It's a lose-lose for employers and employees.

Today, I'm sharing 3 trends that show your clients need another prescription strategy outside of the health plan.

1. Rx inflation is 4x national inflation

Our medical inflation rate is 6% - having grown at twice the national inflation rate for more than 15 years. Rx inflation is now 12%, making it 4x the national inflation rate.

Let's take a minute to put this in perspective. Consider gasoline, another product most consumers consider a necessity. The average inflation rate of gasoline is just under 3%. Most view this as a significant increase. When gas prices spike due to oil prices, summer peaks, or the holidays, consumers will actually change their behaviors. They'll reschedule travel plans, use apps to locate the best local price on gas, etc. Shouldn't the high cost of medications get our attention and spur new consumerism behaviors in the same way?

There's no indication the Rx inflation trend will change. As it continues, more drugs will be removed from health plans entirely, giving members less choice on prescriptions unless they shoulder huge out of pocket costs on their own.

2. Technology for specialty drugs is advancing

We now have the amazing ability to bio-target medications to each individual. This advancement comes with huge cost implications. In the past, folks with the same medical diagnosis usually had access to similar generic drugs, but not today. Specialty drugs are the fastest growing cost component in any medical plan. 2018 will be the first year these meds account for HALF of our national drug spend. Click here to download a one-pager with other stats showing the rise in prescription costs.

Recognizing the exponential growth with these types of drugs makes it critically important to know your groups well. More groups will become self-insured as technology trends create new, customized treatments. Brokers who are familiar with the higher risk cases are better prepared to strategize for their groups.

3. Medical plans are shifting the cost

In the same way carriers have used narrowed networks to reduce plan costs, formularies are shrinking for the same reason. This trend will continue because employers are more willing to have smaller networks and formularies than they are to pay higher premiums. Just last year, over 80 prescriptions were removed from formularies, impacting over 200 million Americans.

This approach only shifts the expense to employees. Simply stripping an expensive diabetes prescription from the medical plan doesn't remove an employee's need for the medication. While similar but not exact replacement drugs work for some, they won't work for others. This reality of less choice for the consumer will impact more and more people as trends continue.

All of this fluctuation makes it hard for a normal American to be a good consumer and find the best price. Most employees just pay the price negotiated by their insurance plan, which may or may not be the best price available. Adding a Presription Savings program creates a safety net to help mitigate gaps in the Rx plan - it works because it gives another option and provides "behind the scenes" transparency to employees. This little, inexpensive benefit can be a HUGE help to employers and employees who are trying to save on their bottom lines. When that solution includes easy price comparison tools, it educates employees as healthcare consumers while giving them options.

Competitive brokers realize these trends can't be ignored and will install new solutions to address prescription prices.

Now it's your turn! How are you handling soaring Rx costs for your clients? Comment below or email us at brokers@freshbenies.com.