3 Strategies & Tips: When To Introduce Telehealth in Plan Design

Have you ever missed an opportunity and kicked yourself for not seeing it or doing it? There’s “seeing” an opportunity and then there’s “doing” something about it. Further, there’s “doing” it right. Just because you’re aware of an opportunity, doesn’t mean you actually took action - and just because you took action, doesn’t mean it was the right action.

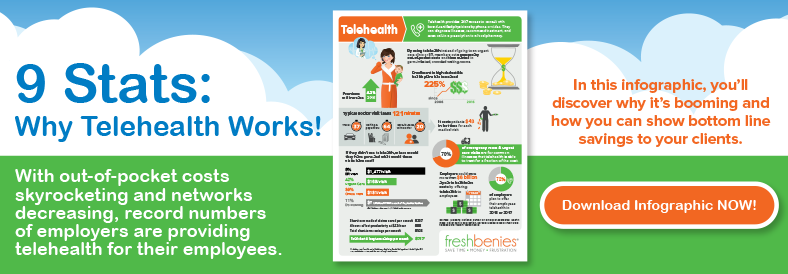

In the employee benefits world, awareness of a new idea doesn’t mean it’s been acted on. Further, it may be acted on, but not implemented strategically. For instance, benefits like dental and vision can be brushed off as a nice-to-have, especially when you’re having a renewal conversation that involves a double-digit increase! I’ve seen this happen with Telehealth, too. Even though this service fills large gaps in service, helps with out-of-pocket costs, contains costs and improves access to care, it’s rarely implemented in the most effective way. Why? Because when you’re presenting Telehealth as an option, timing is everything.

So, when is the right time to introduce telehealth during the annual benefits planning discussion? Here’s a typical example of life as we know it today: You’re delivering a renewal with a large increase. You know the plan designs will need to change to control costs.

The initial renewal conversation is the strategically best time to introduce Telehealth.

Here are a few examples of how to ease the pain of a tough renewal…

Challenge: The employer is facing a carrier change, or the carrier is moving toward a narrow network. In either case, there will be an inevitable disruption in network.

Solution: Telehealth creates an option for more convenient and less expensive access to care that softens the network disruption.

TIP: An Advocacy service can also help find new providers.

Challenge: Out of pocket costs are increasing, as well as co-pays for office visits, emergency room care, etc.

Solution: Telehealth gives an alternative choice for care. It redirects unnecessary emergency room, urgent care, and primary care office visits away from the health plan, while providing a low-cost (or no cost!) consult for employees. According to ongoing telehealth member surveys, when members are asked where they would have gone had they not used a telehealth service, 42% would have gone to urgent care, 39% would have visited a physician’s office, 11% would have done nothing (opening the door for more serious and costly health issues) and 8% would have visited an ER.

Telehealth banner

Challenge: The employer faces an increase in premium at twice the rate of inflation.

Solution: Telehealth benefits reduce the number of unnecessary claims, therefore playing a key role in controlling health benefit costs within the plan.

TIP: You can fund a no-cost telehealth program by finding an extra $10 in the medical premium with all the plan design changes being made. Consider increasing the copays or out-of-pocket costs just a little to make it all work.

When an employer uses telehealth as a strategic solution, employee response is typically very positive. Click here for some examples. Employers are also happy: Calli Corley, Director of Human Resources at The Delta Companies implemented telehealth and advocacy as a solution because, “We get to give our employees their time and sanity back - and we save many times more than what this costs us.”

FINAL TIP!

Don’t wait to bring up telehealth until the end after all the medical changes are complete. Give your clients some good news right along with the not-so-good news…timing matters!

Now it’s your turn! What challenges have you faced in the renewal conversation? Which strategies have proven to be successful solutions? Comment below or email me at joann@freshbenies.com.