4 TIPS FOR OUTSTANDING VOLUNTARY ENROLLMENTS

How are your enrollment meetings going?

In my 15 years in the employee benefits industry, I’ve had my share of great and not-so-great enrollment experiences. I’m sharing 4 tips to help make the most of your voluntary enrollment meetings, particularly with larger groups…

1. Conditions

I’ve found that there are TWO key components for successful enrollments meetings…

1) Require attendance

Benefits have been anything but static in recent years. Yet, according to Aflac’s workforce report, 90% of employees say they choose the same benefit options year after year. How can employees understand new options and make choices that best fit their needs if they don’t attend a meeting?

Requesting a minimum 80% attendance at enrollment meetings is the best thing for both employees and the employer. As a consultant, this demonstrates your commitment to helping the group get the most out of their benefit dollars.

2) Offer space for one-on-one dialogue

Likewise, ensure there’s both time and space to meet with employees who have specific questions or need greater details. This will help drive participation and give employees a confidential environment to ask questions.

2. Communication

It’s true people process information differently, but everyone remembers a story better than a list of facts. When describing a benefit, create a relevant story to demonstrate the use and value of that benefit.

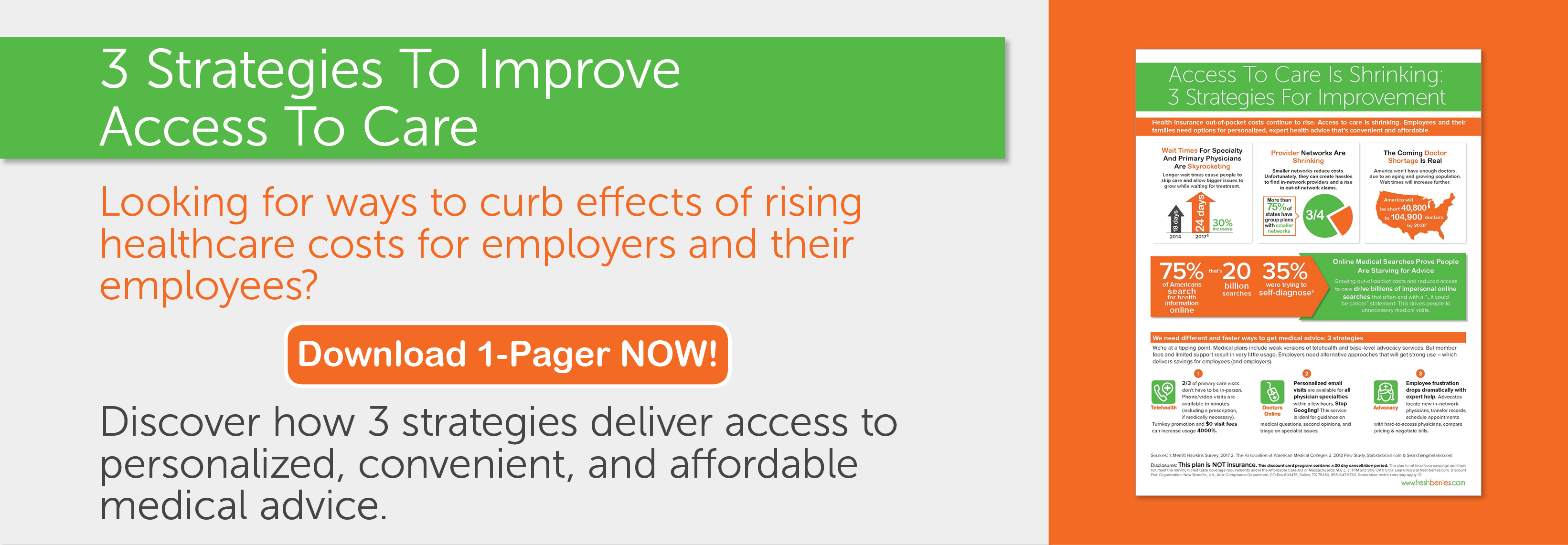

Take telehealth for example. Describing an after-hours scenario where a need is easily met by a phone visit with a doctor makes the point. The employee sees the value of telehealth to provide convenient and speedy access to care with less out of pocket costs. Plus, the employer can explain that avoiding those costly visits reduces health plan costs, as well.

While stories work to cast the vision of a benefit, remember employees are not “one-size-fits-all” when it comes to the details. Be armed with a few methods to communicate specifics like videos, email blasts, flyers, posters and enrollment packets.

Don’t have a hard-hitting story? Ask your carriers/vendors to give you some of their best member testimonials.

3. Commitment

The best open enrollment meetings show engagement at the employer level. Work with the group’s HR team to plan their part of the communication. Will the CEO record a video message about the benefit? Can a few team influencers begin using the benefit early so they can share a quick testimonial about the offerings? How about a letter of endorsement from a manager?

Is Accounts Payable prepared to open more payroll slots? We’ve all been in a scenario where this has been a challenge, right? The perceived value of any voluntary benefit offering is greatly impacted by these details. If a benefit is worth offering, isn’t it worth a bit of coordination to effectively show HR & employer support?

4. Countdown

There should be a distinct strategic timeline when implementing voluntary benefits. The correct plan depends on the existing benefit structure of your group. Typically, the rule of thumb is to offer 1-2 products each year on a 5-year timeline. This allows you to effectively communicate and educate employees on new services without overwhelming them. Remember, voluntary benefits can compete with each other if too many are implemented within the same benefit year. Discuss priorities with your HR contact and plan a rolling timeline that addresses the greatest needs first.

Year-end can be chaotic and sometimes it’s tempting to “wing it” with voluntary benefits. But, winging it doesn’t get the best results.

Now it’s your turn! How do you maximize participation with voluntary benefits? Share your tips in the comments or email me at david@freshbenies.com.