HEALTH SAVINGS ACCOUNTS COULD SOON BE CHANGING

Health Savings Accounts have been around since 2004 and, aside from a few tweaks along the way and an annual adjustment for inflation, are pretty much the same as they were when they were first introduced. That could soon be changing, though. Nearly every major proposal to repeal and replace the Affordable Care Act—including those by Donald Trump, Paul Ryan, and Tom Price—includes multiple suggestions to improve and expand HSAs.

Health Savings Act Of 2017

We may not have to wait for the ACA to go away before we see a change regarding HSAs. On February 15, Senators Orrin Hatch [R-UT] and Marco Rubio [R-FL], along with Representative Erik Paulsen [R-MN], introduced bi-cameral legislation called the Health Savings Act of 2017 (S. 403 and H.R. 1175), signaling that, with or without repeal, HSA expansion will be a top priority this year. The legislation, which is similar to a bill introduced in the last session, is being praised by groups like the American Bankers Association’s HSA Council and the Employers Council on Flexible Compensation (ECFC). Here are the high points:

- Would allow spouses age 55 and older to make catch-up contributions to the same account.

- Would expand HSA eligibility by allowing people with Medicare Part A only as well as people who are part of a Health Care Sharing Ministry to set up a Health Savings Account.

- Would allow for the purchase of over-the-counter drugs with HSA funds.

- Would allow for the purchase of health insurance policies with HSA funds.

- Would change the name “High Deductible Health Plan” to “HSA-Qualified Health Plan”

Many of the ideas from the Health Savings Act of 2017 are also found in some of the initial ACA replacement plans. We’ll soon see which provisions will be included in the unified plan.

Don't Get Confused!

Be careful not to confuse the Health Savings Act of 2017 (H.R. 1175) with the Health Savings Act of 2017 (H.R. 35). It turns out that Representative Michael Burgess, a medical doctor from the state of Texas, introduced a bill by the exact same name on January 3, 2017. The proposed legislation includes several provisions that are found in some of the ACA replacement plans, but the most interesting idea is one that would expand the definition of an HSA compatible plan to include bronze, silver, and catastrophic plans purchased on an insurance exchange.

I LOVE THIS IDEA!! In this day and age, when almost everyone has a high deductible and high out-of-pocket limit, why can’t everybody have a Health Savings Account? Instead, there are weird rules to follow and, as a result, there are actually ACA-compliant plan designs that are ineligible for an HSA because the out-of-pocket exposure is too high. That’s crazy. Of course, the proposal from Dr. Burgess wouldn’t help everyone, just those who purchase a bronze or silver plan through the Marketplace, but it’s a start.

Another HSA Expansion Bill

There’s another HSA bill that was recently introduced called the Health Savings Account Expansion Act of 2017 (H.R. 247 and S. 28). Introduced by Rep. Dave Brat [R-VA] and Sen. Jeff Flake [R-AZ], this bi-cameral legislation would roll back some of the ACA provisions that impacted HSAs, including the one that restricts the use of HSAs for over-the-counter medications and the one that increases the penalty for using HSA funds for ineligible expenses. The most striking provision from this bill, though, is one that would increase the maximum contribution amounts to $9,000 for single filers and $18,000 for joint filers.

The Takeaway

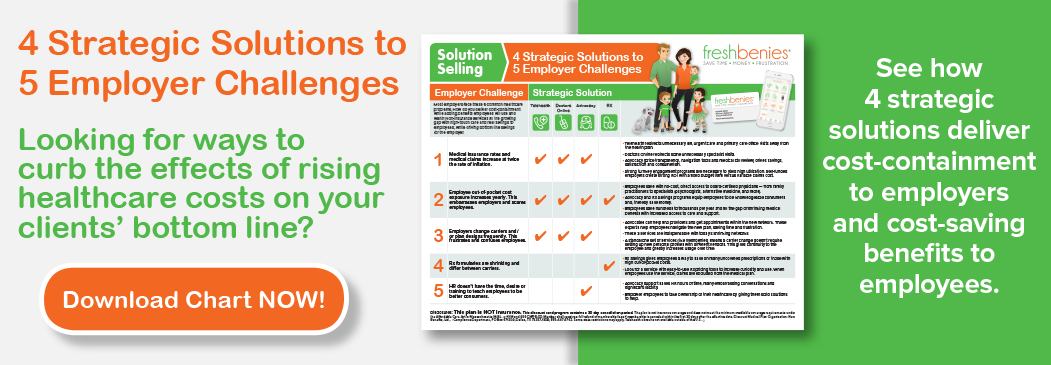

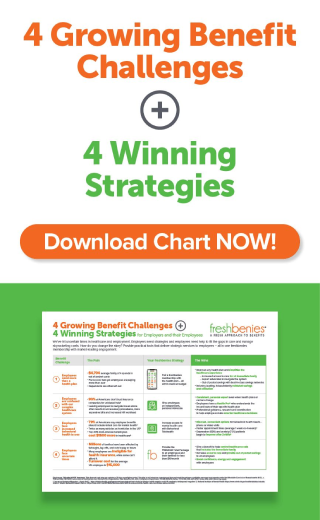

We don’t know at this point if any of these bills will become law or which of the ideas will be included in the eventual ACA replacement plan. But what is clear, is that Health Savings Accounts are a huge priority for a lot of lawmakers this year. And that means that you should be including Health Savings Accounts in the list of ideas you share with your clients. You should also be looking for other solutions that pair well with HSAs.

What Type Of Solutions?

As a broker, selling a High Deductible Health Plan is step one in helping your clients adopt a consumer-directed solution. Encouraging them to set up a Health Savings Account is step two. But there are other steps.

Brokers need to realize that their clients are taking on a lot of additional out-of-pocket exposure when they purchase a high deductible plan, and not everyone has the money to fund their Health Savings Accounts. Fortunately, there are insurance products that will help offset some of the deductible and out-of-pocket risk, including accident and critical illness policies. Most of these solutions will not jeopardize your clients’ HSA eligibility.

Clients also have access issues when they purchase an HSA-compatible plan. Without the up-front copayments for doctor visits and prescriptions, they may not only reduce unnecessary utilization but necessary utilization as well. Giving your clients some alternatives that will help them access needed health care services is critical. These alternatives could include access to a doctor by phone or by email as well as a prescription savings benefit with a built-in transparency tool.

Finally, messaging is critically important when your clients move to a consumer-directed solution, as an increasing number of people will in 2017 and beyond. Because they’re purchasing less insurance, they will need to change their buying habits for first-dollar services, so they’ll need to learn how to “shop around.” Additionally, the perceived value of an employer-sponsored health plan may decrease as the copays are removed and the cost sharing is increased. Employers whose goal is to attract and retain quality employees need to craft the message in such a way that their workers will embrace the change rather than focusing on what they’re losing.

Closing Thoughts

Though we don’t yet know the specific changes that will be made, all indications are that HSAs and consumer-directed solutions will grow rapidly in the months and years ahead. Forward-thinking brokers can start preparing now for that growth. The best way to do that is to seek out insurance and non-insurance solutions that pair well with Health Savings Accounts, identify price and quality transparency tools that will help your clients make better buying decisions, and begin working on the necessary member communication to ensure a smooth rollout.

Now it’s your turn! What signals you to include HSA recommendations with your clients? Are you pairing non-insurance services with insurance services in those conversations? Comment below or email me at eric@freshbenies.com.