ONE COMMON MISTAKE BROKERS MAKE. DO YOU DO THIS?

How many products do you typically review in your usual enrollment discussion with a group client? Medical, ancillary, support (HSAs, benefit admin systems, compliance, etc.) and so on. It’s a bunch and it’s a lot more than in the past, isn’t it?

I believe your discussion and presentation strategy for all these additional products can make or break you. Here’s how I would differentiate our most successful brokers and our least successful:

Our least successful brokers are product-oriented. They pitch ideas like telehealth and advocacy services as a product.

Our most successful brokers are solutions-oriented. They ask lots of questions to develop a “Needs Assessment” which they use to pitch ideas like telehealth and advocacy services as a set of solutions.

Let me paint the picture for you using a common scenario:

An employer faces a rate increase. As a result, their cost-containment strategies include increasing employee out-of-pocket costs, smaller networks, etc. Therefore, the employer needs to balance those changes with other ways that save the employee out-of-pocket costs and/or provide additional ways to access care. Many medical carriers today include telehealth in their plans. Each of the two brokers I described would take a different approach with their employers, and one will be more successful than the other.

Product – oriented approach:

This broker will say, “There’s a consult fee, but telehealth is included in the medical plan, so let’s just use that.” This means the broker is checking the “telehealth box” as complete. The product-oriented approach does not solve the employer’s problem because a typical carrier telehealth plan includes a consult fee and there isn’t a strong engagement program. That means utilization will be about 2% (meaning, in a group of 100 employees, there will be 2 consultations in a year). It also completely ignores the value of other services like Advocacy or Savings Networks to solve some of the challenges. Therefore, the employer’s need to reduce out-of-pocket costs and/or provide more access to care was NOT solved.

Solutions-oriented approach:

This broker will ask consultative questions to glean insight and understanding of every need. As a result, the broker has the ability to offer a more complete and well-rounded solution. In some cases, there may be costs that are added. But, the client understands how it solves their problems and is more likely to move forward, which is an added value that is priceless.

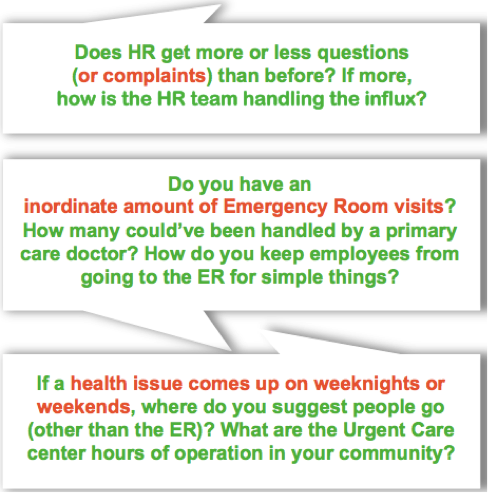

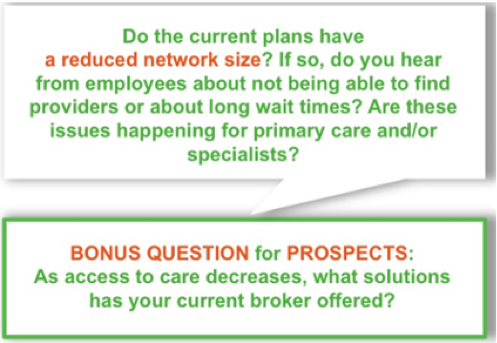

If you want to be the most successful broker, follow my advice. Always look for gaps in coverage where you can offer advice, guidance and solutions that your client wasn’t even aware they needed. Our most successful freshbenies brokers ask these types of questions. Make them part of your Needs Assessment…

WARNING! You already know the direction that most of these answers will take when talking with the employer. It can be awkward and uncomfortable. But you can overcome that when you engage with full curiosity and just listen. It’s not your job to answer every question, but you’ll be much more prepared to help if you dig in to the awkward and uncomfortable.

Once you’ve completed the assessment, you’re more ready to create a total benefit plan for your client (of course, I’d love it if you included freshbenies).

The assessment will guide you toward certain plan designs, and away from others. You won’t have a solution for every issue, but you’ll set yourself up as a “trusted advisor.” This is what makes you a true “consultant.”

I believe this is the only way brokers will thrive in the next 5 or 10 years. If this is a big shift in the way you operate, consider coaching on this consultative style. If you don’t have one, I suggest looking to experts like Q4Intelligence or Bottom Line Solutions.

Now it’s your turn to tell your story! Are you on the journey to become a “trusted advisor" to your clients? How are you learning to do it? What tips do you have to deliver innovative ideas that help your clients? Comment below or email me at reid@freshbenies.com.