PAID OR FREE TELEHEALTH: 2 QUESTIONS TO ASK

“It’s free!” Those are words we all like to hear, right? But, they’re also words that can set off alarms in our minds.

There are times when free or less expensive options are effective choices. We all try to manage our money, and value plays a large part in what we purchase. If there’s a generic drug that offers the same benefits at a lower cost, we’ll take it. Generic food? Sign me up! In reality, they’re probably not identical, and in some cases, it’s worth investigating those nuances.

Today, I’m sharing two questions you can ask to judge between the “free” telehealth benefit you might have in a medical plan vs. a standalone provider, and the savings implications of each.

1. How much is it being used?

There’s a plethora of providers in the telehealth space. Any of them can help your clients save time and money – IF they get used. That’s why knowing the average utilization of any telehealth solution is critical toward your decision. Several factors contribute to getting employees to use this service, such as…

- Do members pay a fee for a visit?

- What engagement materials are provided to promote the benefit and how to use it?

- How often are member communications delivered?

- Is the employee’s family included in the benefit?

- Are there limitations to service areas?

- Do members have multiple ways to access the service (app, online, phone)?

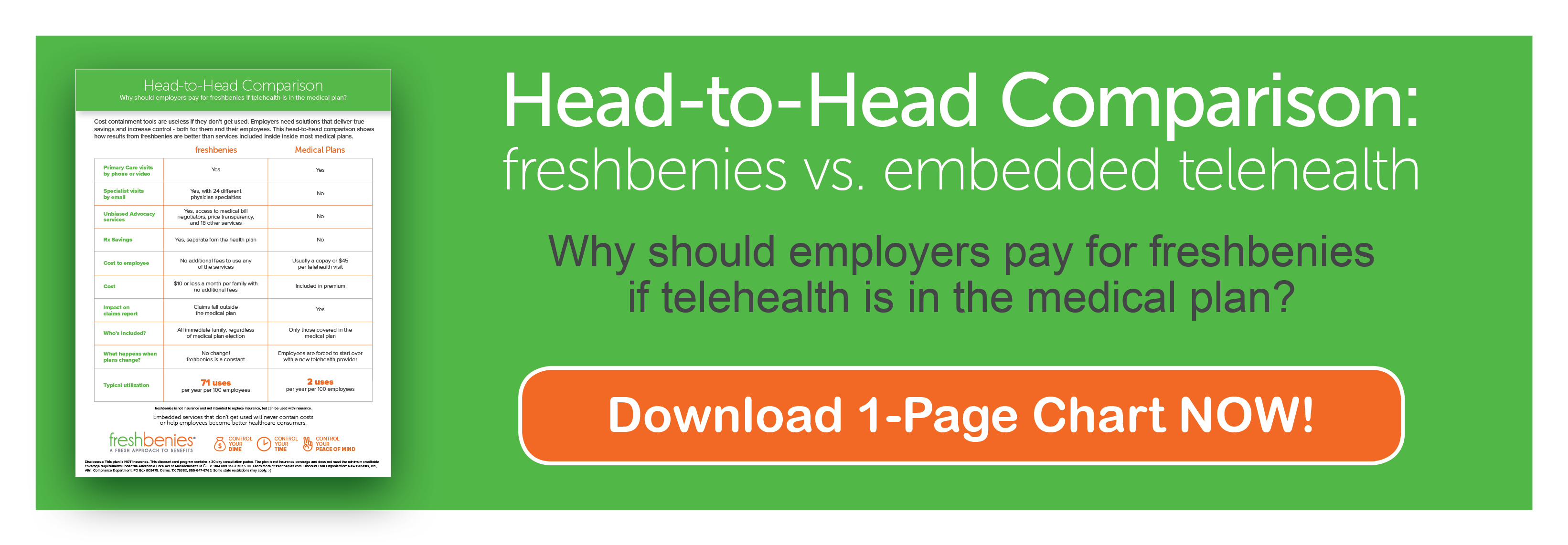

I’ll use our freshbenies utilization average as a comparison to the “free” telehealth within a medical plan. Let’s take a group of 100 employees. And we’ll use an industry-standard value that each telehealth visit saves $518 (based on various studies by Veracity Healthcare Analytics — led by a Harvard University Medical School professor).

Carrier-embedded telehealth has an average utilization of 2%. In other words, that group of 100 would see 2 visits per year. If we multiply the number of visits by the average savings per visit ($518), the savings to the employer is $1,036 per year.

Now let’s compare that to our freshbenies average telehealth utilization of 51%. Now, that group of 100 would see 51 visits per year with a savings to the employer of $26,418 per year.

As the broker, you’re looking for partners that best represent you and your strategies. Which leads me to the next question…

2. What’s the end goal?

This is a question for both you and your employer clients. Are you looking to “tick off the box” that says you offered telehealth, or are you strategically seeking to improve the bottom line, contain costs, and mitigate out of pocket expenses for employees?

Carriers have started rolling telehealth into their medical plans because the service has passed the adoption test and is clearly seen as a useful benefit. However, they don’t usually deliver telehealth in a way to maximize usage. And what about other next gen solutions that help with the growing out of pocket costs?

Beyond telehealth, there are new and different ways to help employees access care and control the healthcare dime, time and peace of mind. Consider the growing challenges telehealth alone doesn’t address…

- 3/4 of states have group plans with smaller networks

- Doctor shortage projections continue to grow, indicating as many as 100K short by 2030

- Wait times for specialty and primary physicians now average 24 days, up 30% since 2014

- Drug formularies continue to shrink

- Americans are performing over 20 billion searches online for impersonal medical advice

What other services might your clients be missing?

Independent advocates address a variety of needs stemming from these growing concerns: find in-network doctors, make appointments, locate specialists, compare pricing on tests & procedures, negotiate bills and more. The ability to have personal email conversations with a variety of specialists provides prompt, expert medical guidance employees can trust. Another prescription savings network outside of the health plan with a built-in pricing tool empowers employees to be better consumers.

These services are equally as effective and deliver real value. While our average freshbenies telehealth utilization is 51%, the utilization on all services is 71% - that includes telehealth plus 3 additional core services. The average savings across these services per use is $442. With 71 uses on telehealth and the other services, that 100-employee group now saves $31,382 per year.

Telehealth is the tip of the iceberg in adopting new consumerism solutions. You might be costing your clients more by sticking with the “free” benefit.

Why should you ask a group to pay for a benefit they might already be receiving for free? When you, as the advisor, can confidently reply, “because you’ll have a better service experience leading to higher utilization of the benefit, which means you’ll save more. And, because you’ll get more services that equip and teach employees to be better healthcare consumers.”

Like all things, you get what you pay for. Pay little, expect little. Pay more, expect more.

Now it’s your turn! How do you make decisions on the value and return of services that complement the health plan? Comment below or email us at reid@freshbenies.com.