WHY PROPOSE BENEFITS FOR THE UNBENEFITED? 3 REASONS

“What are you doing for employees that don’t qualify for benefits or didn’t elect health insurance coverage?” If you aren’t already asking your clients and prospects this question, I’m urging you to start!

Although rising health insurance premiums may make the question challenging for employers to answer, it’s also become increasingly important to ask. I see that there are two distinct ways to serve the unbenefited…

1) benefits the employer can provide

2) benefits the employer can offer

I’m sharing 3 reasons why you should consider proposing benefits for your unbenefited populations...

1. Unmet needs equal opportunity

Two groups of employees represent a severely underserved benefit population:

1. those who aren’t eligible for medical coverage

2. those who didn’t elect medical coverage

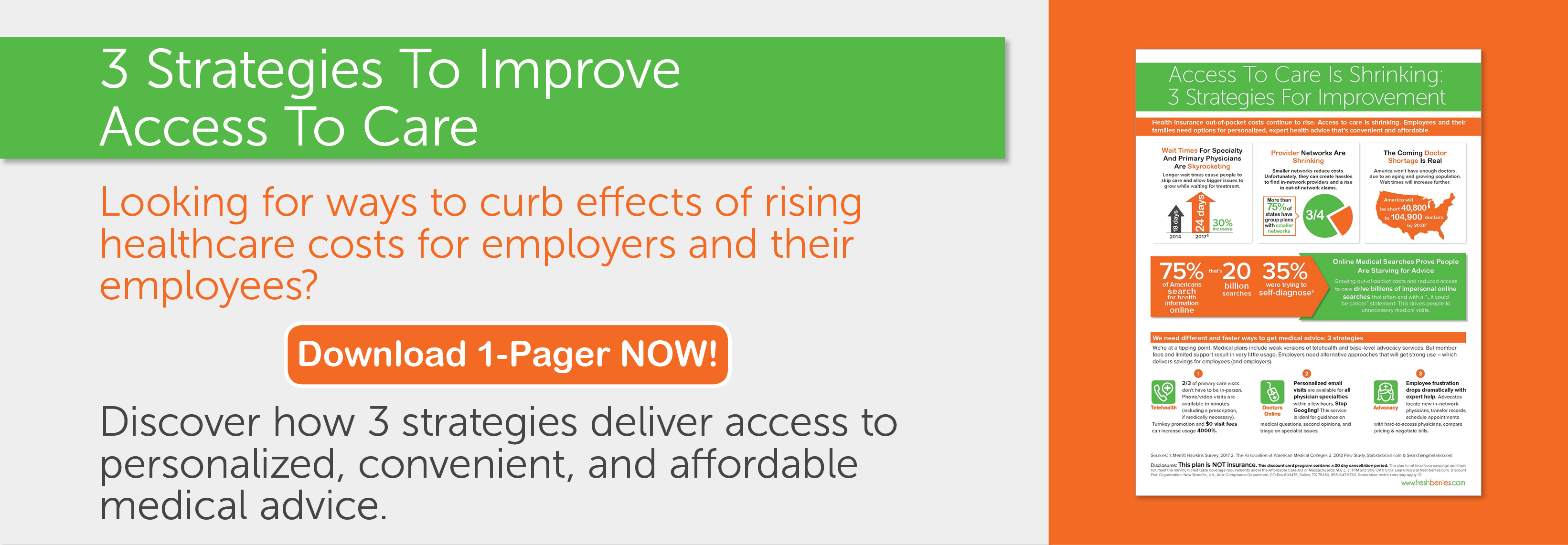

The latest Milliman study shows costs for healthcare are increasing for employees at an even faster rate than employers. This factors into the number of employees who don’t elect medical coverage. Add to this the 28 millionAmericans who work part-time and you can see both the need and opportunity for innovative benefits to serve this population.

Here’s a recent example. A new broker asked me for a proposal for 800 employees. After we discussed the group in more detail, he explained the 800 employees already had medical coverage, but there were over 4,000 employees in the entire group. I asked him, “What about the other 3,200+ employees?” There was silence on the other end of the line.

While our 71% average utilization more than justifies adding freshbenies to employees with existing medical coverage, there’s arguably even more value created by providing services like freshbenies to ALL employees.

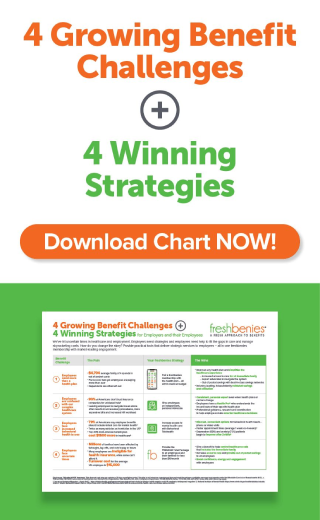

2. A holistic benefits strategy

Providing benefit solutions for an entire group, not just those with existing medical coverage, is a strategy that recognizes and leverages the interconnectedness of employee satisfaction.

Let’s take two employees: Jack and Jill. Both are eligible for health benefits. Jack declines coverage while Jill opts for the new high deductible health plan. For argument’s sake, let’s say both Jack and Jill work equally hard and are equally valuable to their company. Yet, over the course of the next twelve months, Jill’s employer will likely contribute hundreds to thousands of dollars on Jill’s benefit behalf. Meanwhile, they will contribute nothing toward Jack’s.

Which employee do you think will feel more valued by their company? Which will be less likely to look for another position? Which would readily refer a friend for an open position? Of course, the answer is Jill. But doesn’t Jack deserve some benefit love from his employer, too?

And, there are so many more benefit ideas today. Of course, you have the standard worksite benefits like disability, accident, critical illness, long-term care, etc. And there’s also perks like freshbenies, pet insurance, identity theft protection, legal savings, other savings networks, student loan repayment, tuition reimbursement, parental leave, wellness stipends/reimbursements, entertainment passes, remote working, behavioral health/counseling, volunteer time off, etc.

Both Jack and Jill would appreciate some perks. Employers who provide benefits for all their employees, independent from the health plan and eligibility rules, can expect rewards, too...

1. Differentiating themselves from competitors

2. Increased retention at all levels

3. Increased hiring referrals from current employees

4. Depending on the perks, employees who are happy, healthy and engaged while at work

3. Expand your relationships and your portfolio

Approaching your groups with a more holistic benefit strategy allows you to deepen and solidify your relationship with your clients. You’re a strategic consultant ensuring employee pain points are answered while helping employers differentiate themselves with their benefits package. Plus, you’re maximizing the potential of every group!

More of our top broker partners have recognized this void and have started proposing freshbenies for entire groups - not just those with existing medical coverage. It’s a great way to offer valuable benefits at a minimal monthly price.

Now it’s your turn! How do you approach benefit needs of an entire group? How do you include benefit proposals for employees outside of the traditional medical plan?